Grow your business with a trusted payment processor.

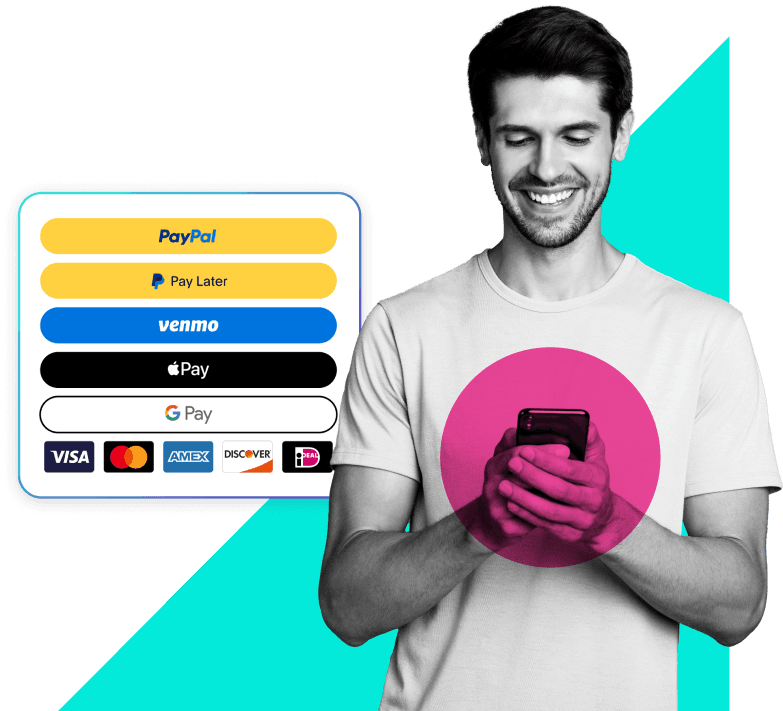

Help maximise your conversion by offering PayPal, Pay in 41, card processing, Apple Pay, Google Pay™, and country-specific payment methods.

BigCommerce Users

New to BigCommerce?

Help drive conversion.

PayPal’s brand recognition helps give customers the confidence to buy. Your all-in-one checkout solution comes with PayPal, Pay in 4, and more. And it can easily be added to your existing checkout solution.

33%

More than 1 in 3 consumers selected PayPal as their most trusted option for online payments.2

Go ahead, let them pay later.

32%

For merchants with Pay in 4 messaging, PayPal Pay Later average order values are 32% higher than standard PayPal average order values.5

Pay Later options available in these countries*

Take charge.

With PayPal, you can process all major credit and debit cards directly on your site. Plus, by bringing payments under one roof you can simplify reporting and consolidate your settlements to better understand your business.

Accept Apple Pay and Google Pay.

Apple Pay and Google Pay are part of PayPal’s all-in-one solution so you won’t have to juggle multiple payment providers.

Make repeat purchasing easy.

PayPal enables you to securely save your customers’ payment methods, including PayPal, Apple Pay, and credit and debit card, providing a quick and easy checkout experience.

Create a fast checkout

With their payment info saved, customers can make repeat purchases in just a few clicks, helping you to improve checkout conversion.

Offer subscriptions

Saving a customer’s payment method allows you to set up recurring payments and charge your customer on a scheduled basis.

Reduce card declines

Card data can be kept current with account updater services to automatically update expired card information to help capture every sale.

Elevate security

Customers' payment information is stored securely by PayPal, helping you ensure compliance and minimise risk.

Go global. Make it local.

With country-specific payment methods, you can reach international customers while making your business feel local. Build trust with local payment options that correspond to the shopper’s location.

More reasons to offer PayPal.

PayPal’s size, scale, and payments volume allows for strong global relationships to help you better serve customers, minimise costs, and help drive sales.

Designed with your business in mind

Payment methods

- PayPal and Pay in 4

- Credit and debit card payments processed right on your site

- Apple Pay and Google Pay

- Local payment methods used around the world8

- Funds credit immediately into your PayPal business account while payments process

- Easy to add to your website in just a few steps

Flexible features

- Save customer billing info for fast, convenient checkout

- Mobile-friendly so customers can easily shop on any device

- Drive authorisation rates, reduce declines, and help capture every sale

- Track all your transactions from one dashboard

- Help drive authentication and fast checkout rates by saving customer card and billing info with card vaulting

- Real-time account updater automatically updates lost, stolen, or expired card details to help boost conversion

Peace of mind

- PayPal helps you handle the risk of fraudulent purchase

- AI-powered fraud detection monitors all transactions

- PayPal Seller Protection on eligible transactions safeguards PayPal Checkout9

- PayPal solutions help you meet global compliance standards

- Additional security offers insights with Fraud Protection on eligible transactions10

- Optional Chargeback Protection to help reduce fraud-related costs11

Apple Pay is a trademark of Apple Inc., registered in the U.S. and other countries and regions. Apple Pay does not charge any additional fees.

Google Pay is a trademark of Google LLC.

*See PayPal Developer documentation for the latest availability of Pay Later features and benefits in your region(s). PayPal Pay Later eligibility and availability is subject to merchant status, sector and integration. Consumer eligibility is subject to status and approval. Product features differ by market. See relevant product terms for more details. PayPal Pay Later cross-border messaging is subject to approval by PayPal.

1PayPal Pay in 4 is a continuing credit contract provided by PayPal Credit Pty Limited (ABN 66 600 629 258; Australian Credit Licence Number 568848) and is subject to merchant and customer eligibility criteria. Full terms and details are available in the PayPal Credit Guide, TMD and PayPal Pay in 4 Facility Agreement on our website.

2PayPal eCommerce Index 2023. This research report was produced in October 2023 by PayPal Australia Pty Limited, based on a study conducted by Fifth Quadrant with n=1,012 consumers and n=408 businesses.

3In Australia, the PayPal Pay Later average order value (AOV) is 38% higher than the standard PayPal AOV for merchants with messaging. // Based on an internal data analysis of Pay Later retailers, October 2020 through August 2023. Pay Later data inclusive of transactions using Pay in 4.

469% of Pay in 4 customers in Australia are repeat users. // Based on PayPal internal data from Jan 2022- Dec 2022. *Repeat Users - who have taken out more than 1 loan.

5Based on an internal data analysis of Pay Later retailers, October 2020 through August 2023. Pay Later data inclusive of transactions using Pay in 4.

6PayPal Earnings-FY, 2023, based on PayPal internal data.

7CR (Consumer Reports), "Buy Now, Pay Later Apps Are Popular, but Are They Safe?" Consumer Reports , May 25, 2023.

8Availability may vary depending on merchant’s integration method and geographic location.

9Available for eligible transactions only. Limits, terms and eligibility criteria apply.

10Available on eligible purchases.

11Terms, exclusions and fees apply to the Chargeback Protection tool. Chargeback Protection is available for accounts enrolled in Advanced Credit and Debit Card Payments. See terms.