Watch Our Product Tour

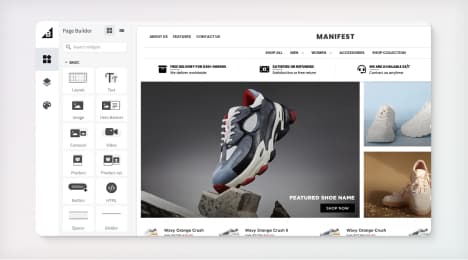

See how BigCommerce helps you build and manage your online store with ease.

- Ecommerce Insights

6 Key Steps to Launch Your Online Store

Explore our Launch Foundations series to get your BigCommerce store up and running quickly.

BigCommerce helps growing businesses, enterprise brands, and everything in-between sell more online.

Start growing your ecommerce business even faster.

High-volume or established business? Request a demo