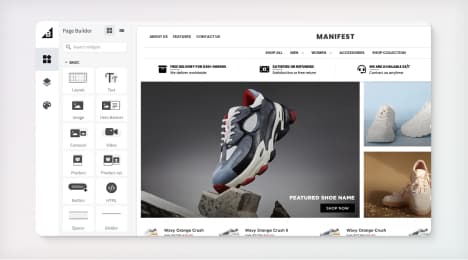

Watch Our Product Tour

See how BigCommerce helps you build and manage your online store with ease.

- Ecommerce Insights

6 Key Steps to Launch Your Online Store

Explore our Launch Foundations series to get your BigCommerce store up and running quickly.

BigCommerce helps growing businesses, enterprise brands, and everything in-between sell more online.

What is a Balance Sheet?

In business, it can sometimes be easy to get lost in the day-to-day. You have so many pulls on your time that you can’t take a breath and see the bigger picture. That’s why many owners and managers graft away without fully understanding their firm’s financial health.

Fortunately, some tools and documents can get you a swift snapshot of how your company’s doing. One such is the humble balance sheet. Read on, and you’ll learn what one of these is, what it shows, and why devising one could be valuable for your business.

What is a Balance Sheet?

A balance sheet is a straightforward financial statement. It provides a snapshot of a business’s assets, liabilities, and shareholder equity at a particular point in time. As such, it is a straightforward yet useful measure of a company’s financial wellbeing.

The sheet demonstrates a business’s worth by laying out what it owns and what it owes. In combination with other statements - such as the income statement or statement of cash flows - it helps you better understand your firm’s finances.

What Are the Main Elements of a Balance Sheet?

The above gives you a general idea of what a balance sheet is. When you examine one, though, what can you expect to see? In general, a balance sheet has three broad sections. They are:

1. Assets.

The assets area of a balance sheet contains everything of value that your business owns. That means anything that could get converted to cash if desired or required. Assets get listed in order of liquidity. That means the first assets listed can most swiftly get turned to cash.

There are two principal categories of assets for your balance sheets. These are current and long-term assets. Current assets can get turned into cash within a year. They may include:

Tangible money in business bank accounts.

Investments you can cash in at short notice.

Inventory on hand.

Long-term assets can’t get converted into cash within a year (or at all). They may include things like:

Fixed assets - property and essential equipment.

Intangible assets - patents on technology or digital products like auto dialer software.

Investments that you can’t sell or cash out quickly.

2. Liabilities.

Your liabilities are everything you owe to others. Once again, these are split into current and long-term categories based on when payment is due. If payable within a year, a debt is a current liability. If not, it’s a long-term liability.

Your liabilities can include:

Rent payments.

Taxes.

Payroll.

Loans.

Pension fund responsibilities.

3. Shareholder’s equity.

Shareholder’s equity is the most often misunderstood part of a balance sheet. The simplest way to think about it is that it represents your net assets. You find shareholder’s equity, after all, by subtracting your total liabilities from total assets.

Why does a Balance Sheet Have its Name?

A balance sheet is called such because it gets split into two halves. On the one hand, there are the assets, and on the other are liabilities and shareholder equity. Those two sides of the scales must always balance. In other words, the following formula should ring true:

TOTAL ASSETS = (LIABILITIES + SHAREHOLDER EQUITY)

What’s the Value of a Balance Sheet?

Why, then, is it essential to draw up and understand your balance sheet? Because it gives you three crucial insights into your business:

1. Efficiency.

Your balance sheet shows you how efficiently your firm uses its assets. If you find that you’re falling short in that regard, you know to make improvements. You might adopt agile project management, for instance, or make managerial changes.

2. Leverage.

It’s essential to know how much financial risk you may face if business slows. Your balance sheet lets you compare debts and equity in order to assess your firm’s leverage. You could then also use the information to calculate your debt-to-equity ratio.

3. Liquidity.

Your company’s liquidity is how much cash you have readily available. This gets shown on your balance sheet and is another essential insight. After all, it could determine if you can afford that small business phone system or to refurbish your offices.

Conclusion

If you want to achieve your goals and strengthen your brand, you must grasp your financial health. You can’t grow or improve until you know where you stand. Your balance sheet is a comparatively straightforward snapshot of your firm’s financial position. It provides insights that can help inform all the crucial decisions you have to make.

BigCommerce helps growing businesses, enterprise brands, and everything in-between sell more online.

Start growing your ecommerce business even faster.

High-volume or established business? Request a demo