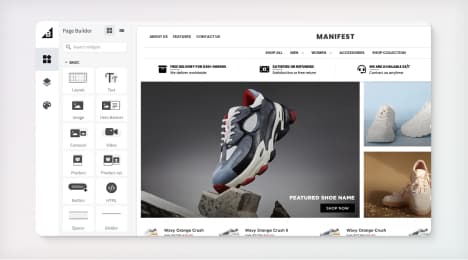

Watch Our Product Tour

See how BigCommerce helps you build and manage your online store with ease.

- Ecommerce Insights

6 Key Steps to Launch Your Online Store

Explore our Launch Foundations series to get your BigCommerce store up and running quickly.

BigCommerce helps growing businesses, enterprise brands, and everything in-between sell more online.

What is Cash Basis Accounting?

There’s so much to learn about modern business. Whatever your industry, there are many avenues you can explore for personal advancement. If one of your professional goals is to find out more about business accountancy, this may be a good place to start.

Before you get into the nitty-gritty of the topic, you must grasp the basics. That starts with the different types of accounting that there are. One kind is cash basis accounting. Read on, and you’ll discover what it is, its pros and cons, and how it measures up to its principal alternative.

Cash Basis Accounting Explained

In cash basis accounting, revenue and expenses get recognized when they’re paid. That’s as opposed to getting accounted for when they accrue.

Say, for instance, a client places a large order for VoIP phones. In cash basis accounting, the revenue from the order gets recognized when the money hits your account. With accrual accounting - more on this later - the order’s value gets accounted for when it’s placed.

The same applies to business expenses. If you contract a freelancer for three months, you might agree to pay them on completion of their work. With cash basis accounting, you’d only record the expense when you pay, not before.

Typically, cash basis accounting is only used by small firms with the most straightforward business models. For instance, sole proprietorships or self-employed individuals. The reasons for this become apparent when you examine the pros and cons of the method.

Advantages of Cash Basis Accounting

There’s one principal advantage of cash basis accounting. That is that it’s far more straightforward. Even the smallest firms or busiest individuals can keep track of money moving into and out of their accounts.

With cash basis accounting, there’s no need for complex accountancy systems. There’s certainly no cause to hire accountants to manage the books. It’s a cheap and straightforward method of accountancy. Unfortunately, it’s not one available to many companies.

Disadvantages of Cash Basis Accounting

First and foremost, many firms simply aren’t allowed to use cash basis accounting. It’s not recognized by the Generally Accepted Accounting Principles (GAAP). Nor is it allowed under the International Financial Reporting Standards (IFRS).

There are practical drawbacks to the accounting method, too. Often, it creates a misleading picture of a business’s finances. That’s especially the case if expenses and revenues for a project don’t fall in the same accounting period.

Say, for instance, you’re an ebook creator. You may get a big contract with a multinational to produce training materials. With cash basis accounting, you only recognize the related revenue when you get the cash. That might be months down the line. As part of the project, though, you’ll have to cover many different costs.

You need to pay writers and graphic designers, among other things. In the accounting period where you pay the expenses, cash basis accounting would suggest poor financial health. In the next period, where you’re paid for the work, it would show a far different picture. Neither representation is wholly accurate. That’s the rub with cash basis accounting.

Cash Basis Vs. Accrual Accounting

Given the weaknesses of cash basis accounting, many firms go a different way. The principal alternative method is accrual accounting. This is when revenue and expenses get recognized as soon as they’re accrued - hence the name.

Say, you’re a business who thinks team morale needs improvement. You might contract a company to provide virtual team building activities. With accrual accounting, you recognize the cost of this as soon as you make the agreement with the firm. It doesn’t matter if you’re not actually going to pay them for weeks or even months.

At a given time, then, accrual accounting provides a more accurate picture of financial health. Accounts payable and receivable are both incorporated into your firm’s finances. Accidents of timing - such as costs and revenues of a project spanning two accounting periods - don’t impact the method’s accuracy.

Conclusion

Cash basis accounting is one method of tracking your firm’s finances. You recognize both revenue and expenses only when cash changes hands. This makes it a less accurate measure of financial health. It’s also an accounting method that’s not allowed for many types of businesses.

There are only a few occasions where cash basis accounting may make sense. These include if you’re a small firm that works mostly in cash or if you’re a self-employed individual.

BigCommerce helps growing businesses, enterprise brands, and everything in-between sell more online.

Start growing your ecommerce business even faster.

High-volume or established business? Request a demo