Explore the

BigCommerce platform

Get a demo of our platform to see if we’re the right fit for your business.

Not ready for a demo? Start a free trial

Competitor Analysis: Find Your Edge in a Crowded Market

Written by

Nicolette V. Beard05/12/2025

What you’ll learn:

Competitive analysis shows you where to succeed. By examining rivals' strengths, weaknesses, positioning, and customer experience, you uncover gaps in the market that competitors aren't meeting — and opportunities to exploit.

External forces shape your strategy as much as your rivals do. Barriers to entry, supplier power, shifting customer values, and substitution threats all influence your long-term competitive advantage.

Your unique strengths create durable differentiation. Physical assets can be copied, but brand reputation, loyalty, and culture form advantages that competitors can't easily replicate.

Pricing is about perceived value, not being the cheapest. The strongest brands compete with shipping policies, convenience, transparency, warranties, and enriched experiences — often letting them charge more.

Ongoing monitoring is non-negotiable. Markets shift fast; weekly, monthly, quarterly and annual touchpoints ensure your strategy evolves as your competitors evolve.

Seeing rivals in your market is a good sign.

It shows that people are already buying what you offer.

Profitable fields always attract many companies — especially when business owners see growing metrics pointing toward demand.

Think about Pepsi and Coca-Cola; their competition exists because so many people drink soda.

Sharing a customer base with others creates a real challenge.

You're both aiming for the same shoppers across identical marketing channels.

To stand out, you need a solid business strategy. A strong analysis shows you what others do well, where they struggle, and how you can earn people's business.

Gaining that knowledge is what this process is all about.

What is competitive analysis?

This type of research identifies who you are up against and what makes them successful. Understanding your competition helps you find effective strategies and see where you can improve to gain ground. Two main viewpoints can guide your research: looking at the big picture and focusing on your strengths. Let’s dive deeper.

Look at the big picture.

Outside forces have a huge impact on your company's performance.

The structure of your industry shapes how everyone competes. Understanding these pressures helps you spot both dangers and openings — especially when entering a new market or evaluating new competitors.

How hard is it to start? Some industries, like online furniture, have high shipping costs. This makes it difficult for new businesses to enter. Big names like IKEA and Wayfair have an advantage because they have built the systems to handle it.

Chair King entered anyway by focusing on outdoor furniture direct-to-consumer, carving out a profitable niche despite the barriers.

Who has more power: you or your suppliers? When Amazon made free two-day shipping a standard, other retailers had to adapt or risk losing customers. A single supplier's choice can set the new normal.

What do your buyers demand? Shoppers' values can change an entire industry. For example, many people now prefer sustainable products. Companies that align with these values often see more sales.

Could a new product replace yours? When Apple removed the headphone jack from iPhones, it created a massive demand for wireless headphones. This move hurt companies that only sold wired options for those phones.

How intense is the rivalry? When many similar businesses fight for the same buyers, they often compete on price points. This can reduce profits for everyone involved.

Focus on your unique strengths.

Your company's internal resources are just as important for building an advantage.

What you own and what you do well determines your success.

Physical items include your equipment, cash and website. These provide a temporary edge, as anyone can buy similar assets.

Unique qualities are things like your brand's reputation, customer loyalty and team culture. These are hard to copy and create a lasting advantage.

Every business has a special mix of skills. For instance, Apple, Sony, and Videopro all sell electronics, but each one succeeds differently. Apple has incredible brand loyalty. Sony uses its large distribution network. Videopro found and dominated a specific professional target market with a focused product line.

Your plan should build on what makes your business special.

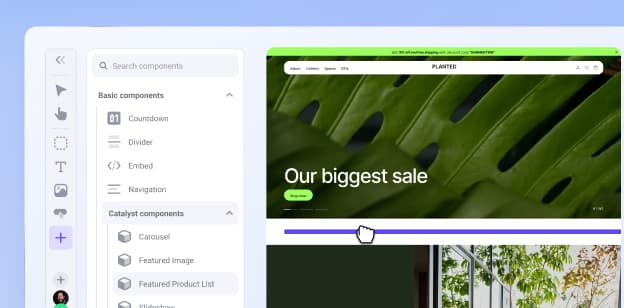

There's a lot to love ❤️

Watch a demo to see the BigCommerce platform in action.

Why this research protects your business.

Online retail sales are compounding at an 8.9% annual rate, attracting new entrants who want a piece of the $6.8 trillion market. While the market grows, individual businesses must fight to keep their customers.

Amazon controls 43% of all US online retail sales. Dominant players set customer expectations for shipping speed, pricing and service. New entrants either match those standards or carve different niches.

This is where a clear plan makes all the difference.

A structured, in-depth review of competitors delivers several benefits:

Find your unique place in the market. Pinpoint exactly how you differ from others in ways that shoppers will value.

Know the true cost of getting started. Understand how much you'll need to spend on advertising and operations.

Meet customer expectations. Your opponents set the bar for prices, shipping, and service. You need to meet or exceed those standards.

Discover untapped opportunities. You can find customer groups, product ideas or service areas that others have ignored.

Identify potential risks early. Spot threats like price wars or shifts in shopper preferences before they can harm your revenue.

A step-by-step guide for conducting a competitive analysis

This research uncovers chances your opponents miss.

The process works best when you follow a system. Perform a deep dive once a year, review prices quarterly, and keep an eye on major rivals continuously.

Dedicate 10 – 15% of your strategic planning time to competitive research. The remaining 85 – 90% goes to execution. Analysis informs strategy but shouldn't prevent action.

Use business intelligence tools like Similarweb to make ongoing monitoring manageable. Price tracking software, SEO platforms, like SEMRush and Ahrefs, social listening tools and product comparison aggregators automate what used to require manual checking.

Step 1: Identify your competitors.

Knowing who you're up against is the first challenge. There are three types of rivals to consider:

Direct rivals sell similar products to your exact audience. Think of Xbox versus PlayStation. They target the same gamers with comparable prices and features. Start your analysis here.

Indirect rivals offer different products that solve the same problem. A meal kit service, for instance, competes with restaurant delivery and frozen meals. They all solve the "what's for dinner?" question.

Future rivals could make your entire product category obsolete. Uber disrupted taxis, and streaming services displaced cable television. They offer a fundamentally new way to meet an old need.

Start with direct competitors, then expand. This is the beginning of a strong competitive analysis report.

Step 2: Perform a SWOT analysis.

A good analysis example is a SWOT analysis, which stands for Strengths, Weaknesses, Opportunities, and Threats.

Performing this type of competitive analysis helps you organise your findings on 3 – 5 of your biggest rivals. Start by digging deep and comparing your top competitors' websites. Document strengths and weaknesses in page site design, product features, and customer experiences.

Keep in mind these themes when conducting your SWOT analysis:

Strengths: What do they do exceptionally well? Look for advantages that are difficult to replicate, like a trusted brand name or exclusive supplier deals.

Weaknesses: Where do they fall short? Try their website and contact their support. Visit review sites and read what customers write. Frustration points for their shoppers are openings for you.

Opportunities: What have they overlooked? What industry trends are they missing? This could be a customer group they are not targeting or a product feature they are missing. One company's oversight is another's chance to shine.

Threats: Could they put you out of business? Consider if they have major funding or other resources that give them an unfair advantage.

Match your strengths against their weaknesses, building a strategy where you can come out ahead.

Step 3: Evaluate their customer experience.

A poor experience can drive shoppers away for good. 70% of consumers abandon brands after just two negative experiences. Which customer complaints receive no response? Analysing a rival's process can reveal gaps you can fill.

A simple way to do this is to become a customer yourself and document every step of your customer journey. Use insights to improve your own site, checkout, and support — especially as you refine your business plan.

Start with a goal. Decide what you want to learn. Focus on their website navigation, checkout process, and support quality.

Form a theory. Based on a quick look, make some educated guesses. For example, "Their checkout process is probably confusing because it requires creating an account."

Test your ideas. You can hire professionals for usability testing, but there are free options, too. Read Reddit forums, watch YouTube reviews, and check social media comments for honest feedback. The best way is often to become a customer yourself. Buy their product and document every step of the journey.

Apply what you learn. Use your findings to improve your own business. If their product photos are bland, make yours vibrant and show the items in real-life settings. Focus on changes that matter most to shoppers.

Step 4: Map their market position.

Positioning maps help you visualise open space in the market. Create simple charts with two axes — such as price vs. quality — and place your competitors accordingly.

For example, in the meal kit space, HelloFresh focuses on convenience, Blue Apron on culinary discovery, and Factor on health. They are in the same category but occupy different territories.

White-space areas often indicate unmet needs.

For detailed positioning methodology, see Philip Kotler's Marketing Management or consult positioning frameworks from reputable marketing strategy resources.

Step 5: Analyse their pricing and value.

Price is a key part of positioning. More than just the dollar amount, you need to look at the total value a customer receives.

People will often pay more for convenience and transparency. Free shipping is a major factor; studies show most shoppers prioritise it over fast delivery. Many will even spend more to reach a free shipping minimum.

Look at the value-adds your rivals offer:

Shipping speeds and return policies

Loyalty programmes and warranties

Customer support and sustainability efforts

Your goal is not always to have the lowest price. Instead, you can add value in areas where your opponents don't.

Step 6: Look at their technology.

The tools a company uses can create a better or worse experience. Two businesses might use the same ecommerce platform but have very different results.

One might add helpful features like augmented reality previews, while the other sticks to the basics. You can use a free online tool like BuiltWith to see what technology your rivals have.

Step 7: Compare shipping competitiveness.

Unexpectedly high shipping costs are the top reason people abandon their online shopping carts. It's crucial to know what your competition offers.

Document their rates for standard, two-day and international delivery. Note their free shipping minimums and return shipping policies. Your strategy should match your budget and what your customers expect.

And always show the total cost before the final checkout step to build trust.

Step 8: Mine social media for information.

Social networks are a great source of unfiltered customer opinions. The top social media platforms businesses can leverage during competitor analysis are:

Facebook and Instagram show you their visual style and how they interact with fans

LinkedIn allows for professional connection between people and businesses. Brand accounts are great providers of new info, such as press releases

X/Twitter provides real-time response times to support queries, product question handling, and brand mention sentiment

TikTok reveals its approach to short-form video and influencer marketing

Reddit often contains brutally honest discussions about products and experiences

When you don’t have time to research these platforms directly, there are free and paid tools that can help, which include:

Free: Social Searcher, native platform analytics, Google Alerts

Premium: Brandwatch (comprehensive monitoring), Critical Mention (media tracking), Sprout Social (cross-platform management)

Look for patterns in the comments. Recurring complaints highlight real weaknesses you can address.

Step 9: Set up ongoing monitoring.

Competitive intelligence isn't one-time research — it's ongoing strategic awareness informing every business decision. As the ecommerce market changes quickly, your analysis should be a continuous effort. Use simple templates to keep your research organised as you conduct regular audits.

We recommend a rough schedule of the following:

Check weekly: Watch for changes in social media strategy and search engine rankings

Review monthly: Look at their traffic and demographic trends and new blog posts

Update quarterly: Refresh your SWOT analysis and check for pricing shifts

Reassess annually: Complete a strategic competitive analysis report to see the big picture

Regular monitoring prevents strategic blind spots. Competitors launching new features, repositioning brands, or changes in distribution signal market direction that you can use to update your ecommerce strategy.

Using competitive analysis tools and templates

Templates keep your research organised and repeatable. Visual collaboration tools and AI frameworks help match your specific needs.

Include essentials such as mission statement, offerings, strengths, weaknesses, competition category, and key metrics.

Visual collaboration platforms.

Mural offers competitive analysis templates with collaborative whiteboard functionality. Multiple team members contribute simultaneously, organising findings visually.

Lucid provides structured competitive analysis frameworks with diagramming capabilities. Map competitor relationships, market positioning, and strategic overlaps.

Both platforms support real-time collaboration, making them valuable for teams conducting joint research.

AI-generated custom templates.

ChatGPT and similar AI tools create tailored competitive analysis templates instantly. Choose prompt complexity based on your experience level.

Simple prompt (beginner-friendly):

"Create a competitive analysis template I can use to evaluate 3 – 5 competitors in my industry. Include sections for company overview, target audience, positioning, product/service offerings, pricing, differentiators, website experience, SEO, content marketing strategy, customer sentiment, and opportunities/risks."

This generates a basic framework covering essential competitive dimensions.

Intermediate prompt (more structured):

"Act as a competitive strategy analyst. Build a detailed competitive analysis template I can use to benchmark multiple competitors. Format it so it's easy for me to fill in for each competitor.

Include:

• Company snapshot • Product/feature comparison table • Pricing model breakdown • Messaging + positioning review • Website UX evaluation criteria • SEO + content performance indicators • Sales funnel + conversion insights • Strengths, weaknesses, opportunities, threats (SWOT) • Key differentiators"

This produces structured comparison tables and evaluation criteria.

Advanced prompt (fully customised):

"I'm conducting a competitive analysis for a [describe industry or product]. Create a thorough, professional competitive analysis template that includes:

• Competitive landscape overview • Direct vs. indirect competitor classification • Unique value proposition comparison • ICP and buyer-journey mapping • Pricing strategy + packaging matrix • Feature parity grid • Website + UX diagnostics (speed, navigation, CTAs, conversion paths) • SEO audit checklist (ranked keywords, backlinks, content gaps) • Marketing strategy comparison (paid, organic, social, partnerships) • Customer feedback mining framework • SWOT and strategic recommendations

Present this as a fillable template I can reuse."

This generates comprehensive analysis frameworks customised to your industry and competitive landscape.

Essential template components.

Whether using pre-built tools or AI-generated templates, include these baseline elements:

Mission statement: Positioning and market approach

Main offerings: Flagship products or primary services

Sales channels: Distribution methods like Google Ads, and platforms like webinars and podcasts

Strengths: Competitive advantages and differentiation

Weaknesses: Vulnerabilities and gaps

Competition category: Direct, indirect, or replacement competitor

Key findings: Research summary and supplementary material links

Always including these essential components during competitive research enables deeper analysis using the nine-step framework covered earlier. Businesses can always add custom categories as competitive intelligence needs evolve.

Update templates quarterly as the business landscape shifts. Reusable frameworks make ongoing monitoring systematic rather than starting from scratch each cycle.

The final word

A competitive analysis isn't just a research exercise — it's your roadmap for standing out in a crowded, fast-moving market. By understanding how rivals operate, where they excel, and where they fall short, you can develop a business strategy with clarity and confidence.

Whether you're entering a new market or strengthening your position in an established one, continuous monitoring and structured research ensure you stay ahead of changes in both customer expectations and competitive behaviour.

With the right structure and templates in place, competitive intelligence becomes an ongoing advantage, helping you protect your position, uncover new opportunities, and stay ahead of the next shift in ecommerce.

FAQs about conducting a competitor analysis

Is SWOT a competitive analysis?

SWOT is one competitive analysis tool, not the entire analysis. It identifies competitor strengths, weaknesses, opportunities, and threats. Use SWOT alongside other marketing efforts — like pricing analysis, positioning maps, customer research — for complete competitive intelligence.

What happens if I don't do a competitor analysis?

Failure to complete some form of competitor analysis can lead you to underestimate market entry costs and required startup capital. You risk launching products with poor market fit, wrong pricing, or weak differentiation. Without competitive intelligence, you're guessing instead of making informed strategic decisions.

Does competitive analysis take a long time?

Basic direct competitor analysis usually takes 2 – 4 hours. Comprehensive market research, including customer interviews, usability testing, and market share analysis requires 2 – 4 weeks (on average). To figure out the level of analysis your business needs, scope your timeline to analysis depth and competitor count.

Should I analyse competitors if I sell niche products?

Yes, businesses that sell niche products also benefit from analysing competitors. Niche markets risk being too small for profitability, having irregular demand, or limited spending power. Competitive research validates market viability before you invest resources. Small businesses benefit significantly from understanding competitive dynamics.

How do I turn competitive analysis insights into an actionable strategy?

Identify competitor weaknesses you can exploit. Match their strengths where customers expect parity. Differentiate where you have unique advantages. Prioritise changes impacting revenue and where you can optimise — pricing adjustments, feature additions, improved customer experience — over cosmetic updates.

How often should I update my competitive analysis?

Review quarterly for pricing, features, and digital marketing tactics. Conduct a comprehensive annual analysis for strategic positioning. Monitor major competitors' products continuously through automated tools. Update immediately when competitors launch significant products or reposition their brands.

How can I benchmark a competitor's technology stack without insider access?

Use BuiltWith or Wappalyzer to identify platforms, analytics and marketing tools. Test checkout flows to discover payment processors. Subscribe to competitor emails revealing marketing automation. Monitor job postings mentioning specific technologies competitors use.

Find your favourite features.

Explore all of the capabilities of the BigCommerce platform.