by Annie Laukaitis

25/04/2025

Ecommerce has become an essential part of the shopping experience, and it’s here to stay. By 2025, global retail ecommerce sales will surpass $4.3 trillion, and in the US, B2B ecommerce is on track to more than double from $1.7 trillion in 2021 to over $3 trillion by 2027.

From big-box retailers to niche suppliers, businesses of all types are going digital — and fast. With the growing volume of online purchases, brands have more opportunities than ever to expand their customer base and deliver seamless, personalised shopping experiences.

But what exactly is ecommerce?

Short for “electronic commerce,” ecommerce refers to the buying and selling of goods and services over the internet. This includes everything from product drops on social media and mobile app orders to complex B2B transactions through digital platforms.

This digital exchange happens across a wide variety of models, including B2C (business-to-consumer), B2B (business-to-business), and hybrid approaches like B2C2B, where online interactions span multiple layers of the supply chain.

In this article, we’ll take a closer look at how ecommerce has evolved, the business models driving its growth, the opportunities and challenges brands face online, and the tools that power successful digital storefronts.

Types of ecommerce business models

Generally, there are seven main models of ecommerce that businesses can be categorized into, each catering to different audiences and types of transactions. Let’s review each type in more detail.

Business-to-consumer (B2C).

One of the most popular sales models is B2C ecommerce, which involves transactions made between a business and a consumer. For example, when you buy shoes from an online retailer, it’s a B2C ecommerce transaction. Some of the most popular ecommerce businesses today are B2C sellers — think Walmart, Target, or Sephora.

Business-to-business (B2B).

Unlike B2C, B2B ecommerce encompasses online sales made between businesses, such as a manufacturer and a wholesaler or retailer. B2B is not consumer-facing and happens only between businesses. For example, many popular tech companies, such as Hubspot, Slack, and Microsoft, primarily sell their products and services to other businesses.

Consumer-to-consumer (C2C).

One of the earliest forms of ecommerce, consumer-to-consumer, involves the sale of products or services between customers. This can also include any provider that manages a C2C online transaction, such as those seen on eBay or Amazon. A prime example of a C2C sale is when someone uses an online marketplace, such as Facebook Marketplace or Craigslist, to sell a good or service to another person.

Direct-to-consumer (DTC).

A newer model of ecommerce, DTC refers to a business that sells products directly to the end customer instead of going through a retailer, distributor, or wholesaler. One common example of DTC ecommerce is a subscription-based brand such as Netflix or Dollar Shave Club.

Many of DTC businesses also sell digital products, such as templates or online courses, directly to shoppers.

Consumer-to-business (C2B).

C2B flips the traditional retail model on its head, in that individual consumers make their products or services available for business buyers. This could look like a photographer selling stock photos to an ecommerce business like iStock, or an influencer promoting its ecommerce marketing services to a business.

Business-to-government (B2G).

B2G covers the transactions made between online businesses and government entities or public administrations. For example, businesses can sell software related to legal documents or social security to local government agencies.

Consumer-to-government (C2G).

Similar to B2G, C2G ecommerce involves consumers selling goods or services to government organisations, and a C2G business is any ecommerce company that facilitates these transactions. For example, utility companies allow home and business owners to make online payments through a government website for energy-related services like electricity or gas. These businesses help foster better communication between consumers and government entities by simplifying payment processes and administrative tasks.

Sizes of ecommerce businesses

From small startups to large enterprises, ecommerce businesses can come in all sizes. Let’s look at the main four you’re likely to come across.

Enterprise.

An enterprise ecommerce business is a large-scale organisation that often has a more complex structure and needs. These businesses tend to offer a much wider range of products and services, as well as serve multiple audiences, including consumers and other businesses.

Mizuno USA, for example, is one of the most recognizable sportswear brands in the world. To support growth, the brand needed an ecommerce platform that would help them optimise their tech stack and stay ahead of evolving consumer expectations.

"Mizuno USA was using a monolithic legacy solution that was heavily customised over the years, and that made innovation challenging. It limited their ability to experiment, try new things, or run necessary campaigns," said Sergei Ostapenko, CEO of Mira Commerce. "They needed a tech stack that balanced form, function, and performance, and BigCommerce's composable solution was the perfect fit."

Mid-market.

Mid-market businesses are exactly what they sound like — in the middle of small, mum-and-pop businesses and big-name enterprises. While there’s no set standard to identify a mid-market company, the size of a business can be measured through metrics such as annual revenue, net income, or number of employees.

A great example is Chair King Backyard Store, a Texas-based outdoor furniture retailer. As a large-scale furniture brand, Chair King offers white-glove delivery and localized selling, which meant it needed a customisable checkout experience. Turning to BigCommerce, the furniture brand found the features and functionality to enhance its user experience.

“BigCommerce is a better user experience for our customers, and it's also a better user experience for the team that's supporting it,” explained Kristen Brown, Director of Ecommerce for Chair King. “It's definitely pushed us forward even within our space. I think we have one of the more updated websites for the niche market that we're in.”

Small business.

Small businesses are sole proprietorships, partnerships, or corporations that sell products or services and make less money and have fewer employees than large multinational corporations. The U.S. Small Business Administration further defines a small business in terms of employment (from 100 to over 1,500 employees) or average annual receipts over time (ranging from $1 million to over $40 million).

Wheels and Wings Hobbies, for example, is a small business hobby shop making big moves in the ecommerce space. With BigCommerce powering its commerce engine, the brand has amplified its user experience for both shoppers and backend teams.

“People say it’s so hard to get good technology for a good price, but BigCommerce is literally right there,” shared Dan McCowan, Owner of Wheels and Wings.

Startups.

A startup is a business or project in the first stages of development, often built by an entrepreneur to pursue an innovative business model. Typically, a startup has less than 100 employees, however startups are often defined not by size but by profitability.

Molly Mutt, a company selling high-quality dog beds and crate accessories, is a prime example. With a lean team and a growing business, the brand needed an ecommerce platform for startups that was fully customisable, easy to set up, and could scale with the business.

“We've enjoyed developing on BigCommerce because we can customise where we need to, but the base functionality is rock solid so we can always depend on that,” explained Matthew Coles, Account Director at Modelic, Molly Mutt’s agency partner. “But then we still have some freedom to do some interesting workarounds and customisations to make sure that we're servicing the end customer well.”

Growth of ecommerce

Ecommerce has evolved dramatically, from CompuServe in 1969 to today’s global digital economy. What once was a niche convenience is now a core part of how businesses operate and consumers shop.

The rise of smartphones and widespread use of mobile devices has made it easier than ever for shoppers to browse, compare, and purchase products from anywhere, at any time.

Key growth highlights show:

U.S. retail ecommerce sales grew from $27.6 billion in 2000 to nearly $1.2 trillion in 2024.

The global B2B ecommerce market reached $19.34 trillion in 2024, with projections of $47.54 trillion by 2030.

As of February 2025, 5.56 billion people, 67.9% of the global population, were internet users.

From early experimentation to exponential growth, ecommerce has become essential to the modern economy, spanning industries, business models, and borders.

What technology is involved in ecommerce?

When launching an ecommerce business, you’ll need a core set of tools and systems to ensure basic functionality, such as a robust ecommerce platform, a reliable payment gateway, and an efficient order management system. But as your business grows, you might want to incorporate advanced technologies like customer relationship management (CRM) software, inventory management systems, and marketing automation tools to meet more complex business requirements.

In this section, we’ll dive into the most common technologies that can help you build a successful ecommerce operation.

Ecommerce platform.

An ecommerce platform is the engine for your online business. Powering the backend of your tech stack, an ecommerce platform contains the necessary tools to help you build and run your online store, such as payment processing, marketing tools, inventory management, and more.

Depending on your business needs and development capabilities, you may choose to host your site on a SaaS platform that provides pre-built, native commerce functionality. Popular platforms like BigCommerce, Shopify, and WooCommerce offer flexible solutions for building and scaling your ecommerce business, whether you're just starting out or managing a large product catalogue.

With BigCommerce, businesses of all sizes, from startups to global enterprises, can grow on the same powerful platform and scale seamlessly as their needs evolve.

Payment gateways.

A payment gateway is an essential functionality for completing online transactions, as it allows your ecommerce site to securely process payments.

Today, many customers expect businesses to offer flexible payment options at checkout. In fact, 13% of customers will abandon their carts if they don’t see enough payment methods available.

For many ecommerce businesses, this means offering an array of payment options, such as credit cards, digital wallets like Apple Pay or PayPal, Buy Now, Pay Later (BNPL), and even cryptocurrency.

Shipping and fulfillment.

Shipping and fulfillment are critical components of any ecommerce operation, ensuring that orders are efficiently delivered to customers.

With BigCommerce, merchants can streamline their operations using a comprehensive suite of tools, including real-time shipping quotes, automated order fulfillment, and seamless integration with major carriers like USPS, UPS, and FedEx. This ensures that customers receive their orders quickly and accurately, enhancing their overall shopping experience and driving customer satisfaction.

Data and analytics.

A successful online business leverages data and analytics to gain insights into customer behaviour, ecommerce trends, and overall business performance. By deploying advanced analytics tools, businesses can make informed decisions, optimise their strategies, and drive future growth.

Point-of-sale (POS).

Today, some of the best ecommerce businesses are the ones that create a seamless shopping journey across all touchpoints — both online and in-store. With a point-of-sale (POS) system, businesses can easily manage in-person transactions and seamlessly integrate orders and inventory between their ecommerce platforms and brick-and-mortar stores, allowing them to provide the unified shopping experience that customers expect.

Enterprise resource planning (ERP).

Enterprise Resource Planning (ERP) refers to software that automates business processes, from supply chain to customer relationship management (CRM) to, most often, financial systems. ERPs enable organisations to create a single source of truth for their data and connect unrelated APIs to each other for a larger, more cohesive enterprise system.

Product information management (PIM).

Today’s PIM software collects, manages, enriches and distributes product information across distribution channels, from your ecommerce storefront to social sales channels, marketplaces and even advertising networks.

A PIM can become your single source of product truth by acting as a central hub for your product content management, then syncing it across your tech stack — ecommerce platform, ERP, OMS and other third-party integrations.

Inventory management.

Whether you're managing your own inventory or working with a dropshipper, inventory represents a major financial investment, both in its initial cost, and the cost accrued by having to store it. Luckily, inventory management systems track stock levels, track and manage orders, and forecast demand to ensure products are available when customers want them, while also preventing overstocking.

Marketing integrations.

Marketing integrations play a critical role in attracting, engaging, and retaining customers. Many ecommerce platforms offer built-in tools or seamless integrations for email marketing, social media marketing, and SEO, making it easier to run targeted campaigns, boost visibility in search results, and drive traffic to your storefront. With the right marketing stack, businesses can create a cohesive brand experience across channels and increase conversion opportunities.

Product feed management.

To maximize reach across channels, product feed management is essential. Tools like Feedonomics allow ecommerce businesses to optimise and syndicate product listings across marketplaces, search engines, and social platforms. By ensuring accurate, high-quality product data across every channel, businesses can improve discoverability, drive performance, and reduce manual errors.

Customer relationship management.

A CRM system helps businesses centralize and organise customer information, from purchase history to communication preferences. This enables more personalised marketing, better customer service, and long-term loyalty. For ecommerce businesses looking to scale, CRM tools are key to delivering the kind of tailored experiences today’s shoppers expect.

Benefits of ecommerce

Ecommerce has a number of advantages, from faster buying to the ability to reach large audiences 24/7. Let’s take a look in detail at some of the top perks ecommerce has to offer.

Reach new customers to increase sales.

First and foremost, ecommerce makes it easier for companies to reach new potential customers. Since your online shop isn’t tied to a single physical storefront, that means it’s open and available to any and all customers who visit it online.

With the added benefits of social media advertising, email marketing, and SEO (search engine optimisation), brands also have the potential to connect with massive target audiences who are in a ready-to-buy mindset.

Scale and streamline operations.

Ecommerce allows businesses to scale rapidly and streamline operations by automating processes, optimising inventory management, and leveraging data analytics for informed decision-making. This efficiency enables companies to reach more customers, reduce costs, and improve overall performance.

Gain customer insights.

Many ecommerce platforms offer native marketing tools to gain deep insights into customer behaviour, preferences, and trends. By analysing this customer data, businesses can personalise shopping experiences, improve marketing strategies, and build stronger customer relationships, ultimately driving loyalty and growth.

Sell globally.

As technologies continue to advance and our world becomes ever more interconnected, international expansion will be not just a choice, but a necessity. Luckily, many ecommerce platforms like BigCommerce are already aiding merchants today, both big and small, to expand across borders and scale their businesses exponentially.

Low startup costs for small businesses.

Without a need for a physical store (and employees to staff it), ecommerce retailers can launch stores with minimal startup and operating costs. And those that run a dropshipping business can even minimise upfront investment costs.

Personalised shopping experiences.

With the help of new technologies such as artificial intelligence (AI), ecommerce brands can deliver hyper-personalised online experiences for their ecommerce audience. Showcasing relevant products based on past purchase behaviour, for example, can lead to higher average order value (AOV) and make the shopper feel like you truly understand their unique needs.

Ability to sell on other online channels.

One of the biggest advantages of ecommerce is the flexibility to reach customers beyond your own website. By selling on online marketplaces like Amazon, Etsy, and eBay, through search ads, and across social media platforms like Facebook and Instagram, businesses can expand their reach and drive more sales. To do this effectively, product feed management is essential. Solutions like Feedonomics help automate and optimise product listings across multiple channels, ensuring consistent, high-quality data that improves discoverability and performance wherever your products appear.

Challenges of ecommerce

Although modern ecommerce is increasingly flexible today, it still has its own setbacks. Here are some of the downsides in more detail.

Integrating with the current tech stack.

If your development team has invested heavily in your existing tech stack, integrating new tools or features can become challenging. However, with BigCommerce's open APIs, businesses can seamlessly plug and play new functionalities, ensuring smooth integration and compatibility with their current systems.

Customer service and returns.

For customers who want to get hands-on with a product (especially in the realm of physical goods like clothing, shoes, and beauty products) before adding it to their shopping cart, the ecommerce experience can be limiting.

Consistency across channels.

With the growing need for omnichannel commerce, ecommerce businesses face the challenge of creating a consistent user experience across multiple channels. Online brands must cater to customers across social media, mobile apps, online marketplaces, in-store, live chat, and more.

Competition.

With a low barrier of entry comes an increasing number of competitors. To stay ahead, businesses must continuously innovate their marketing strategies to maximize ROI and differentiate themselves in a crowded ecommerce market, ensuring their offerings resonate with target audiences effectively.

Shipping and fulfillment.

Depending on the size of your business and product catalogue, managing shipping and fulfillment can be a huge pain point, especially if you’re working with multiple suppliers.

Data security.

As an ecommerce business, you’ll have a huge responsibility to protect the privacy of your customers. Implementing robust encryption and regular security audits are essential to protect against fraud, cyber threats, and data breaches, ensuring customer trust and compliance with industry standards.

Understanding international trade and compliance.

If you decide to go into global ecommerce, you’ll need to be able to navigate diverse regulatory landscapes. From data protection laws like GDPR to product safety regulations and taxation requirements, ecommerce businesses must meticulously assess and adhere to various regional regulations.

Rising consumer expectations.

In the age of same-day shipping and AI chatbots, ecommerce is making shopping more fast, convenient, and accessible than ever — and shoppers expect more and more. As an ecommerce business, you’ll need to be continually in lock step with changing consumer expectations.

Technical issues.

If your ecommerce website is slow, broken, or unavailable to customers, this may impact your ability to make sales. Site crashes and technology failures can damage relationships with customers and negatively impact your bottom line.

How BigCommerce helps ecommerce brands

BigCommerce is built to help brands grow smarter, not just bigger. Whether you're a fast-scaling DTC brand or an established B2B business expanding online, BigCommerce offers the flexibility, performance, and tools needed to thrive in today’s competitive ecommerce landscape. Here's how:

Convert more shoppers into customers.

With built-in conversion tools like optimised checkout, faceted search, and support for digital wallets and Buy Now, Pay Later (BNPL) providers, BigCommerce helps reduce friction and boost conversion rates. Brands can also tap into advanced promotions, A/B testing, and powerful analytics to fine-tune the shopping experience and turn more browsers into buyers.

Cut down on operational costs.

BigCommerce’s SaaS model eliminates the need for costly hosting and maintenance while offering enterprise-grade performance and security. The platform’s open API architecture and automation capabilities reduce manual tasks, helping teams do more with fewer resources and lowering total cost of ownership over time.

Customisable storefronts and integrations.

BigCommerce supports a wide range of front-end solutions and back-end integrations, giving merchants the power to build exactly what they need without compromise. From payment gateways and ERP systems to shipping providers and CRMs, merchants can tailor their tech stack while maintaining speed, security, and scalability.

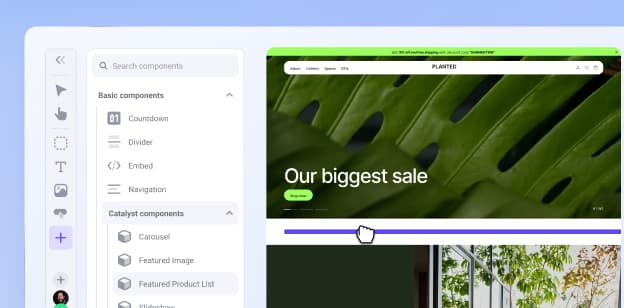

Create stunning composable storefronts.

BigCommerce gives customers the freedom to build blazing-fast, beautifully branded storefronts using Catalyst — its composable storefront framework built on Next.js. Catalyst provides the tools developers need to create modern experiences with complete design control and faster time to market. Whether you're launching a campaign landing page or redesigning your entire storefront, Catalyst makes it easier to deliver immersive shopping experiences that stand out and perform across every device.

The final word

Ecommerce has transformed from a digital convenience into a driving force behind the global economy. With trillions of dollars in projected sales and a wide range of business models, from B2C and B2B to emerging hybrid approaches, ecommerce offers unmatched potential for brands of all sizes.

But navigating the ecommerce landscape requires more than just a great product. It takes the right mix of technology, strategy, and flexibility to meet rising customer expectations and compete in a rapidly evolving market.

That’s where BigCommerce comes in. With a scalable, open platform, robust out-of-the-box functionality, and the freedom to innovate through APIs and composable architecture, BigCommerce empowers brands to launch, grow, and thrive in today’s digital-first world. Whether you're just getting started or expanding globally, BigCommerce has the tools to help you build the ecommerce business of your future.

Discover how BigCommerce can fuel your ecommerce business. Book a demo today.