5 Telltale Signs Your Business is Battling Credit Card Fraud

How often does your site experience fraud? And how much do you lose to chargebacks or credit card fraud each year? Chances are, fraudsters are hurting your business more than you expect. The true cost of every bad transaction consists of not only lost merchandise but also lost profit, bank fees and the associated costs that go with shipping, sourcing, handling and managing the frustrations of chargebacks. It all adds up: merchants lose an estimated $3.5 billion in online revenue to fraud annually.

As daunting as it seems, you have the power to stop these fraudsters and protect your online store from ecommerce fraud. Even if you only have a few seconds to process an order, a real time fraud solution can flag malicious users and help you block bad orders. Fraudsters don’t stand a chance against big data.

Merchants lose an estimated $3.5 billion in online revenue to credit card fraud annually.

At Sift Science, we have thousands of fraud analysts in our global network of Fraud Fighters. Every time a merchant on our network sees fraud, the signals associated with that user or transaction update instantly for all Sift users, thanks to online and automated machine learning. Based on our takeaways from our hundreds of customers, thousands of sites and millions of transactions, here are five warning signs to help you spot (and stop) fraud.

1. First-Time Shoppers

Freshly minted accounts might suggest criminal activity, since fraudsters are always on the prowl looking to test credit cards on unsuspecting sites. Also, most online shoppers have some sort of shopping history. Look out for users who may create email addresses purely to purchase with stolen credit card numbers or abuse referral/promotional codes.

2. Suspicious Orders

Do you usually order 40 of the exact same thing? Neither do most good customers. But cybercriminals want to get as much as possible on a single order, since they’re using stolen credit cards and those credit card numbers could be canceled at any time. While it’s nice to have options, a shopper that suddenly purchases multiple high-priced items is suspicious. Fancy watches, designer purses and limited-edition kicks are easy to buy in a variety of sizes and shades.

Cybercriminals often maximize a single order since they’re using stolen credit cards.

3. Out-of-the-Ordinary Shipping

“Rush” or “overnight” shipping on orders is often a red flag, since fraudsters want to receive their stolen goods before the real cardholder cancels any transactions. Also, keep an eye out for shipping that extends beyond your shop’s usual audience. While global customers can be a sign of growing business, they can also be an indicator of online organized crime or purchases on stolen credit cards.

4. Non-Matching Data

Although your customers may be sending gifts or shipping to school addresses, be wary of non-matching data points. If you notice that multiple accounts and credit cards share a single shipping address, you could be facing a single user with a bundle of stolen cards. Multiple accounts and shipping addresses that share a single billing address could indicate organized criminal activity, originating from a single hub.

Meanwhile, differences in billing and shipping addresses, telephone area codes and zip codes, and orders at odd times of day all deserve a second look.

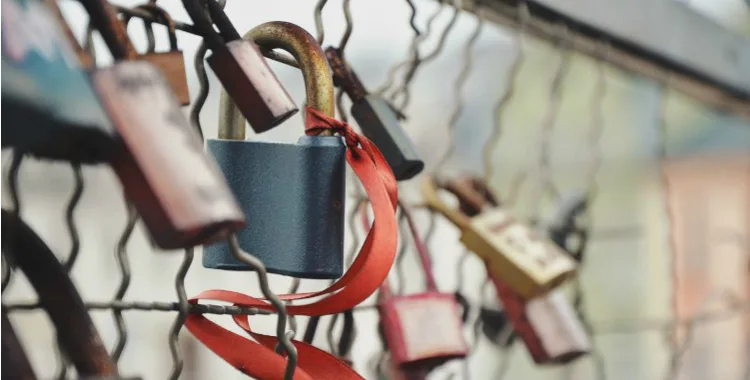

5. Too Many Credit Cards

Did you know that the average American only has 2.6 credit cards? Be sure to look for a greater-than-normal number of cards associated with a single account or IP address, as this could indicate fraud.

A greater-than-normal number of cards associated with one IP address could indicate fraud.

Of course, you can’t rely on just a single fraud signal without considering all of the other data that flows into your site. Successful fraud detection hinges on seeing the big picture and analyzing thousands of signals. Large-scale machine learning offers an all-in-one view, predicting a user’s likelihood of fraudulence based on that user’s global shopping fingerprint. With a big data-powered solution like Sift Science, you can visualize how each of these details relate to one another for every user and transaction for your site.

For more information on the how to detect fraudsters, check out our blog on the Seven Habits of Highly Fraudulent Users.

Emily is the brand manager at Sift Science, where she works on content, culture and communications. Before becoming a Siftie, she worked in water diplomacy and experiential marketing. You can regularly find her event-wrangling, cranking on blog posts and enforcing mandatory fun time.