by

You have seen the headlines, data and stories across the board — selling on Amazon makes people and brands a lot of money.

That's because Amazon has become a selling behemoth, with a projected $162 billion in ecommerce net sales in 2022 and more than three-quarters of U.S. households being Amazon Prime members.

Selling on Amazon can be an immensely profitable product channel for brands, businesses and hopeful sellers.

Just like with any other channel, however, it is essential that you understand what it takes to sell on Amazon and how best to initiate that journey. The opportunity is immense — as long as you know what you're doing.

Why an Omnichannel Mindset is Important for Your Business

As the world of online and digital sales continues to grow, forward-thinking businesses are increasingly pivoting into an omnichannel mindset.

Omnichannel sales and marketing is a strategy that seamlessly integrates the multiple channels of the shopping experience — from the brick-and-mortar location to the ecommerce online store. Through omnichannel, each and every step and touchpoint of the customer journey is accounted for.

For those who wish to sell on Amazon, an omnichannel mindset will allow you to consolidate and streamline both your Amazon and external business.

Sell more, however your customers shop.

Seamlessly blend brick-and-mortar with ecommerce when you unlock Buy Online, Pick Up In Store (BOPIS) functionality on BigCommerce.

Things to Consider Before Selling on Amazon

Before selling on Amazon, make sure to consider the following:

Is your business a good fit for Amazon?

This is the essential question to be asked prior to selling on Amazon. There are some business and product types that may sell better on more niche marketplaces and may not be a good fit for Amazon.

On the other hand, your product may be tailor-made for the world’s largest marketplace. Make sure to do your due diligence with product research and keyword research — prior to selling.

Almost anyone can list products for sale on Amazon.

Due to the fact that almost anyone can list products for sales, the scope of competition on Amazon is unlike virtually any other market out there.

You may see that your product listing or service type is a best seller on Amazon. While that’s good news in one regard, it also means that your competition level will be even higher. Will your business be able to stand apart enough to outsell those around you?

It’s a critical question — and one you should answer early.

Amazon wants sellers to use Fulfillment by Amazon (FBA).

Fulfillment by Amazon (FBA) is a service offered by the Amazon Fulfillment Center as a means for third-party sellers to automate their order fulfillment and shipping services.

While you can opt-out, Amazon is clear in that they would prefer all of their sellers use FBA for fulfillment and shipping options. If your business is predicated on a specific delivery model, then you should know beforehand that Amazon’s terms of service will likely interfere with that.

Amazon owns the customer relationship, not you.

At the end of the day, sellers must remember that it is Amazon that owns the customer relationship, not you. This can be extremely helpful considering how many customers Amazon interacts with and their generally positive reputation.

However, if your business is one that prides itself on a unique style of customer interaction, then the separation inherently provided by selling on Amazon may not be the best option for you.

The Different Business Models for Selling on Amazon

Once you have decided to sell on Amazon, the next step is to decide which business model works best for you.

Reseller.

Amazon resellers typically go for the retail arbitrage option. This is a method a finding low-cost or discount goods at a physical retail store, then selling it at a higher price on Amazon — all while pocketing the difference.

It is a fast and common way of making money, but it is a time-consuming process and involves searching for and identifying potential options.

Private label seller.

A private label seller sells products that a retailer gets produced by a third-party but sells under its own brand name. This typically helps smaller entrepreneurs take advantage of larger markets to advertise their products under their own brand.

With ecommerce platforms such Amazon, Walmart and Alibaba, there is already an established audience of buyers — by simply adding your brand, you can quickly make a name for yourself.

White label selling.

White labeling involves taking generic products, adding your brand name to them and then selling it as if it were you — thus saving time on manufacturing or product design.

Selling white label products on Amazon is relatively easy compared to other marketplaces, simply because of the nearly limitless options available. It can be accomplished via bulk order out of the Amazon warehouse or by surveying the marketplace.

Determine Your Amazon Selling Strategy

There are two ways to sell through Amazon:

1. Sell directly to Amazon.

2. Sell on Amazon yourself.

However, the process is a bit more complicated than just that. When determining your selling strategy on Amazon, consider all of the following:

Sell directly to Amazon.

Amazon is growing its direct catalog, and it may be the best idea to swim with the tide, not against it.

Aside from Amazon becoming your customer instead of your competitor, selling directly to Amazon can eliminate the job new sellers are worst at — forecasting and marketing your product become Amazon’s duty.

Many items sold by Amazon sell for more and faster, not to mention the margin difference for FBA sellers not competing against Amazon here.

Selling on Amazon.

Start by selling on Amazon yourself if you find it easier to get up and going, or use this to complement your sales to Amazon.

Selling on Amazon — along with selling to Amazon — can keep Amazon honest and prevent the whims of their algorithm from leading to stockouts of your own products.

Additionally, by selling to Amazon, you can jump-start sales of new products by giving Amazon’s bots the confidence they need to start bringing it in themselves.

Digital Goods

Digital goods and products refer to intangible items delivered electronically, such as music, software, eBooks and podcasts.

If your business strategy involves selling digital products, Amazon is a wonderful avenue. With its extensive Kindle book store available for eBook purveyors and Amazon Music for aspiring musicians, the options are expansive and open.

Services

It is not just digital and physical goods that are available to be sold on Amazon. Professional services have quickly become a lucrative option for Amazon seller accounts, with services offered on the platform ranging from appliance technicians to auto mechanics.

When establishing your selling strategy, make sure to review if it aligns with what works on Amazon and see if there’s a gap in the market.

Who is your customer?

Perhaps the most important aspect of setting a strategy is understanding who your customers are and where they’re located.

You may have a product or service to provide that you are proud of, but if there isn’t a base to sell to, you’re only setting yourself up for failure. By identifying a solid, reliable customer base, you will have the greatest chance for success.

What are you capable of?

Before you start selling anything, make sure that you are aware of what you are capable of.

Honesty is needed here, as well as a frank assessment of the possibilities of your business. How many companies or individual sellers have failed simply because they were overly ambitious?

Set yourself up for success by acknowledging the constraints of your business and product.

What is best for your product?

What is the goal of your business or product? What category should it be located within?

Before launching your Amazon store, review the product categories available on Amazon and see where your product would best profit from. Specificity can be helpful, but it can also get your product lost in the shuffle.

Ensure that your product is in a position to excel, and you’ll never regret it.

What is your positioning?

Another often overlooked aspect of selling on Amazon is understanding your position in the market.

Do you have a product that people want to buy? Is there a demand for it?

Like the section above, much of this can be solved by reviewing Amazon’s best sellers and examining if your product or service is poised for high Amazon sales. If the product category you anticipate your items to sell in isn’t particularly lucrative, it may not be the best investment idea.

Launch Your Ecommerce Store

Create your own store and start selling today with our risk-free trial.

The Multiple Costs When Selling on Amazon

Direct costs.

Direct costs refer to your acquisition costs per SKU, including shipping. They can also refer to the expenses involved with manufacturing or purchasing products.

Indirect (overhead) costs.

Indirect costs are the unseen or behind-the-scenes costs incurred when selling your product. They can include such expenses as:

Warehouse costs.

Utilities.

Insurance.

Bookkeeping.

Payroll and benefits.

Business travel.

Corporate business tax.

Product samples.

Web development.

Amazon fees.

Amazon fees refer to the costs you will incur to sell on Amazon. They can include expenses such as:

Sales commission.

Fulfillment fees

Selling fees.

FBA fees.

FBA inbound shipping fees.

Commission on returned products and refunds.

Storage fees.

Return shipping and disposal costs.

Handling returns.

Handling returns expenses refer to the costs incurred from write-down and write-off costs from being unable to sell these returned products as new-condition products.

Identify Trends That Can Cost Money

Returns.

While some products may have a high return rate, you may easily be able to resell all of those items as new a second time if a customer doesn’t open or tamper with the product before returning it. Other products may have low return rates but are a complete write-off if returned.

If you are forced to resell the SKU as used following a return, there is a write-down cost incurred by not being able to generate the revenue you would have received were the item in new condition.

It’s crucial to monitor return rates and related costs because they will occasionally be high enough to warrant removing the products from your catalog. Alternatively, you may have the option to push part of that cost onto your distributor/supplier with whom you share the returns-related cost data.

Stockouts.

Inventory stockouts occur when you run out of inventory for a particular item. They happen to even the most experienced Amazon sellers and have the potential to be one of the most significant leaks in your profitability bucket.

To prevent stockouts, consider the following possible scenarios:

1. An Increase in Customer Demand.

An sudden increase in customer demand can happen naturally or as a result of a broader trend.

Since product trends can be difficult to predict, the best solution is to build a buffer into your buying strategy and buy extra stock. Keep in mind that this strategy has drawbacks as well. If your product doesn’t sell, you risk paying those pesky FBA storage fees.

2. Season Variations.

If you are selling seasonal items, you’ll want to monitor changes in your historical sales rank and stay on top of other factors, like weather patterns, to help predict inventory levels. This can be tracked through spreadsheets or third-party software.

3. Complications with Your Supplier.

Be your supplier’s best customer and maintain open lines of communication with them at all times. This way, you can be alerted in advance to any changes in their product line or SKU volume and adapt your strategy accordingly.

Most importantly, you’ll know if any of your best-selling items are about to be discontinued, allowing you to buy up a bunch of extra inventory.

4. Changes in Demand Resulting from Competition.

It’s crucial to regularly monitor your sales volume, price changes and variations in sales velocity for your SKUs.

Depending on your competition, you may want to increase your price to get even more of a profit margin out of this temporary spike in sales. Competitors jumping on a listing is becoming a common occurrence.

Ultimately, be aware of opportunities to diversify and expand your portfolio so that losing a few SKUs won’t make or break your business. The more diverse you are at the brand, supplier and SKU levels, the lower your risk.

Ecommerce Business Metrics You Should Know

Key Performance Indicators (KPIs) are crucial for the success of any business. They can help you evaluate your success at reaching key targets, allow you to spot trends and problem areas, and assess your overall performance.

Here are the most important KPIs to evaluate the health of your Amazon business:

Inventory to sales ratio.

This key metric covers multiple areas of your business. It indicates the overall health of your inventory and highlights your sell-through rate.

Inventory turn.

This ratio shows how often a company’s inventory is sold and replaced over a period of time. A low turnover rate implies poor sales and, therefore, excess inventory.

Gross Margin Return on Investment (GMROI).

GMROI is a ratio used to evaluate inventory profitability. A ratio higher than 1 means you are selling the merchandise for more than the total cost it took to acquire it.

Cash-to-Cash Cycle.

Cash-to-Cash Cycle measures the amount of time it takes for capital invested to go from cash to the production and sales process and back to cash.

This metric looks at the amount of time needed to sell inventory, the time required to collect cash owed, and the time a company has to pay its bills without incurring penalties.

The longer your cash-to-cash cycle is, the more time your cash flow is tied up.

Days of Inventory (DOI).

This KPI will help you see the average number of days an item is held in inventory before it is sold. It’s instrumental in determining order quantity to ensure you are not overstocking or stocking out of your inventory.

How to Sell Successfully on Amazon

Learning how to sell on Amazon can be overwhelming for beginners. However, the process is much more simple than you might think.

To find success, first consider the following steps:

Utilize Amazon Seller Central.

When you register to become an Amazon seller, you will gain access to Amazon Seller Central. It is a portal that allows you to manage all aspects of your Amazon business, from your professional selling account and adding product information to handling payments.

Understanding your Amazon Seller Central account and the extent to which it can help your business is invaluable for business owners.

Optimize your product detail page.

Before you start thinking about generating traffic, putting any marketing budget to work, or refining your Amazon pricing strategy, you have to do the basics.

On Amazon, this means you have to optimize your Amazon product detail page for Amazon's organic search results.

The majority of sales on Amazon begin through product searches. Spending time optimizing your products for Amazon's search engine is not only forward-thinking but ultimately profitable.

Set your pricing correctly.

If you get your pricing wrong, you will either lose money or won’t sell anything. Setting the right price on Amazon doesn’t have to be that hard for products where you don’t have any competition on your Amazon product page.

In general, there are two variables you need to consider for every single product you sell on Amazon.

1. You want to be profitable.

2. You want to maximize profits.

You need to consider all your costs and what your prices would be for you to be profitable on Amazon.

How to calculate your Amazon floor price

To operate in the green, you need to know all your costs, consider them and then determine your price floor.

Below is a list of costs you must take into your equation:

Product Acquisition Costs.

Shipping products.

Customs.

Payment wiring.

Amazon Commission.

Amazon FBA Fees.

Customer Return Fees.

Returns-related fees.

Variable overhead allocation costs.

There are also category-specific costs to consider. For example, if you sell clothing, Amazon will charge FBA fees related to customer return shipping costs.

How to find your upper price limit

The ultimate goal is to have your products ranked on page one of Amazon search results. This is where the magic happens, and you can sell volume.

However, getting your products to page one with deep marketing pockets is one thing, but you want your product to stay there while generating sustainable, profitable organic sales.

To get your products there, you must first evaluate the competition. Search for your top three keywords for your product and review the pricing of the search results on page one.Then consider if your prices are within a reasonable range of what you have found.

You should not be 20% more expensive than the highest price on page one of search results. If your price is higher, you will most likely never reach the top of Amazon search results.

Keep your prices stable.

To build customer trust and a sustainable long-term brand on Amazon, it is essential to keep your prices as stable as possible — even if it means cutting your prices close to break even or below profitability.

However, before you even think about cutting prices below profitability, remember that you will only be successful selling on Amazon once you can generate organic sales with a decent profit margin.

How to Drive Traffic to your Amazon Products

Without traffic, there are no sales. Simply listing your product on Amazon and hoping for traffic and sales is not enough to be successful.

Today, you need not only the organic traffic on Amazon, but you need to drive traffic from external sources to your Amazon product page.

The following are several strategies you can use to drive traffic:

Build an email list.

An email list is a great way to boost your sales at a product launch.

However, you may wonder how you can build a list since Amazon doesn't provide email addresses from customers, and you are not allowed to write them for marketing reasons.

Begin with these three easy-to-implement ways to start building your list:

1. Add a sign-up field on your websites, such as a newsletter sign-up or an ebook download.

2. Communicate your newsletter sign-up option on social media channels and packaging.

3. After a sale on Amazon, you can send one email to your customer. Point them to your newsletter sign-up page.

Run targeted Facebook ads.

Today, Facebook Ads are one of the most important external paid traffic sources. You have multiple advertising options on Facebook without needing an existing customer base.

With Facebook Ads, you can define your target audience and create a post that will show up directly in a user’s Facebook feed.

Use Amazon Sponsored Product placements.

Amazon Sponsored Products is a fantastic avenue for increasing impressions and page views.

They work similarly to Google AdWords, where you bid on search terms. If a person is searching on Amazon for your product, you can buy an ad relative to those search terms, and your offer will appear next to the best results.

Amazon Sponsored Products is straightforward and can be set up in minutes. However, ensure you manage your Amazon account carefully and regularly to avoid an exploding marketing budget.

Point all product links to Amazon.

You may ask why you should send customers to Amazon if you already have a proprietary website.

The reason? Your goal should be to place on the first page of search results — preferably in the top three listings. This is where big money is made, not by a single sale on your site.

Apart from your website, you should also point every link on Facebook, Twitter, YouTube, Instagram, blog posts and email newsletters to one specific Amazon product page.

Get your products in the hands of influencers.

YouTube is the world's second biggest search engine, and social media companies like Facebook and Twitter aren't far behind.

It's good to have many reviews about your products to show up early in search results, no matter where potential customers search. Choose YouTubers, bloggers and social media influencers who best fit your product and brand, and offer them free review samples.

Here are a few tips for outreach:

Be sure to word your outreach genuinely and help solve a problem for their audience.

Know that they receive many of these emails regularly.

Keep a running list of who you are reaching out to and who responds.

Use this to build yourself an influencer list.

Maximize your product packaging.

When someone orders something from you, it represents an opportunity to expand the scope of your business.

With every package, you can add a little something extra to help advertise your business and offer potential discounts. By doing this, you can increase your customer satisfaction and retention rates, while opening your business up to customer reviews and word of mouth.

Create effective Google Ad campaigns.

Google Ads is one of the best ways to advertise and promote your products on Amazon, with more than 25% of sellers using the solution.

To get the most out of Google Adwords, you should:

Focus on brand name: Focus on your brand name and the most specific keywords in the long tail.

Focus on long-tail keywords: In the long tail, you should create specific campaigns for each product, including the product name, the material and the color.

Craft exceptional product detail pages.

Product detail pages are where your customers will view and find products sold on Amazon. If you’ve ever shopped on Amazon, you’ve probably come across one.

By implementing a method known as product listing optimization, you can tell customers all they need to know to help them source products. Make sure to emphasize the following bullet points:

**Product Title:**Product titles are extremely important as they are the first thing your potential customers see.

**Product Description:**Make sure you fill this with informative information about your products, as well as pertinent keywords.

**Featured Offer:**A featured offer or Buy Box should be included on every single product page.

**Product Images:**Make sure that each of your product pages has clear, high-quality and easily viewable photographs.

**Guide:**If you are selling a service of a complicated product, make sure to provide a step-by-step guide on how to use it.

How to Get Real Amazon Product Reviews

Without product reviews, you won’t sell anything on Amazon. The amount and the quality of reviews are the most critical components of increasing your conversion rate.

Here are a few ways to increase your number of authentic product reviews:

Email your customers after purchase and ask for reviews.

You can use tools like Feedback Genius to automate this process.

1. Send the email a few days after the purchase.

2. Ask neutrally, and don’t force them to leave a positive review.

3. Provide a direct link to the review page, as many of your customers have probably never written a review.

You can also use this opportunity to ensure the product was delivered correctly and give the customer a chance to tell you about their experience.

Use positive seller feedback to get good product reviews.

People often confuse seller feedback with product reviews. Unfortunately, often excellent product feedback is not always visible to other customers

Review your seller feedback regularly for people who provide positive product feedback and ask them via email to write a product review.

Comment on reviews.

Everything on an Amazon product page is public. In particular, almost all future customers will read the reviews and comments sections.

This is your chance to stand out.

Be sure to comment on any negative product reviews or reviews where a customer has questions. Here is an opportunity to build trust and increase your conversion.

Furthermore, many customers who initially gave your product a negative review might even change it for a positive one because they are grateful that you cared about their issue.

Ask customers who email you for feedback.

The easiest way to get high-quality product reviews on Amazon is by simply asking customers who tell you how much they love your product.

Whenever you receive an email, a customer service call or positive feedback on your social media channels, ask them politely if they are willing to share their experience with other customers on Amazon.

How to Provide Outstanding Customer Service

You can do no wrong if your Amazon customer benefits. Amazon itself is among the most customer-centric companies in the world. They expect the same standard from you as a seller.

The best marketing tool on Amazon today will be outstanding customer service. Your goal should be to craft the kind of experience that will sustain and grow your customer base and help spread word of mouth.

Start your customer service on your Amazon product page.

Amazon product pages are where all your customers start their customer journey, read reviews, ask questions, check out your seller feedback and finally click the Add to Cart button.

When reviewing your product pages, make sure to:

Comment on negative product reviews and offer instant help.

Answer questions in the Q&A section.

Manage your seller feedback actively.

Answer your customers quickly and generously.

The second pillar of your customer service must be email. Ensure that you answer all emails within at most 24 hours and strive to resolve every customer service interaction in a single session.

When interacting with email, apply the following four principles:

Answer all emails within 24 hours.

Provide a solution in your first reply.

Make it simple for your customer.

Be generous.

Be responsive on your social media channels.

Your customers will likely expect you to engage with them on their favorite social media channels. With channels like Facebook and Twitter, you can easily exceed expectations and wow your customers with quick, succinct and helpful replies to their questions or concerns.

Additionally, you should provide a FAQ section on your website that answers common questions, and offer an easy-to-use contact form.

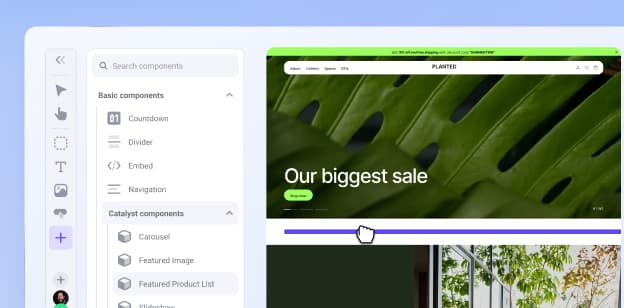

How Does BigCommerce Integrate with Amazon?

As Amazon holds the title of the world’s largest online marketplace, any ecommerce platform must be able to integrate within it successfully.

With BigCommerce, Amazon integration is easy-to-use, simple to implement and seamless to sell. Our industry-leading integration will let you list your products on Amazon directly from the BigCommerce control panel, with centralized inventory management and order processing and fulfillment.

Omnichannel Commerce

BigCommerce integrates with over 150 marketplaces, social channels and search engines so you can sell more everywhere.

The Final Word

Don’t let the size and scope of Amazon’s marketplace scare you. Even with over 300 million active customer accounts and over 1.9 million selling partners worldwide, selling on Amazon has never been easier.

If you have a business idea, there’s no need to wait any longer. With the help of BigCommerce, you can tap into Amazon’s massive potential seamlessly and at the touch of the button.