The explosive growth of global ecommerce is not just a trend, but a promising future for businesses. This growth drives a parallel expansion in payment processing volume. As consumers and merchants increasingly prefer digital channels, online money transfers have become the new transaction standard.

According to industry projections, the global payment gateway market will reach an impressive $161 billion by 2032, registering a remarkable 20.5% compound annual growth rate between 2023 and 2032.

But what exactly is a payment gateway? It's not just a technology, but a guardian of your online transactions. At its core, the critical technology enables secure online transactions for ecommerce retailers. These gateways are the essential conduit between sensitive payment details and acquiring banks or payment processors, ensuring a safe and efficient digital commerce experience.

In this rapidly evolving landscape, businesses that embrace cutting-edge ecommerce payment technologies while creating intuitive, user-friendly websites will establish a significant competitive advantage in the digital marketplace.

The essential components of ecommerce payment processing

Ecommerce payment processing services are the lifeblood of online businesses, enabling secure and seamless electronic transactions between merchants and customers. Understanding these critical components will help you build a robust payment infrastructure for your online store.

Payment gateway: Your digital point-of-sale.

Think of a payment gateway as your virtual cash register. This secure technology encrypts sensitive customer information, such as credit card details, and safely transmits it between all parties involved. Popular providers like Stripe, PayPal, Authorize.net and Braintree offer reliable gateway services that integrate easily with most ecommerce platforms.

Payment processor: The transaction handler.

Working behind the scenes, ecommerce payment processors manage the communication of transaction data between your business, the customer's bank (issuing bank), and your bank (acquiring bank). Many card companies now offer combined gateway-processor solutions, with industry leaders like Stripe, Square, and PayPal providing comprehensive services under one roof.

Merchant account: Your business banking solution.

To accept card payments, you'll need a specialized merchant account. However, modern payment platforms have simplified this requirement by allowing businesses to operate under their master merchant accounts, significantly streamlining the setup process and reducing barriers to entry for new online stores.

Security and fraud prevention: Protecting your business.

Online transactions inherently carry more risk than in-person sales. To safeguard your business and customers, implement robust security measures, including:

Address Verification Services (AVS)

Card Verification Value (CVV) checks

3D Secure authentication (Visa Secure, Mastercard Identity Check)

Tokenization technology

Advanced fraud detection algorithms

These tools work together to create multiple layers of protection against unauthorized transactions.

PCI DSS compliance: Meeting industry standards.

The Payment Card Industry Data Security Standard establishes the security framework all businesses handling card information must follow. Failure to comply can result in significant financial penalties and damage your reputation. Fortunately, most modern payment gateways and processors handle much of your compliance burden, particularly regarding data storage and transmission security.

By thoroughly understanding and implementing these key components, you'll build a payment ecosystem that provides security, convenience, and reliability for your business and customers.

Understanding the payment processing pipeline

Understanding the payment processing pipeline is not just a technicality, but a crucial part of your ecommerce journey. When a customer purchases online, their payment travels through an intricate yet lightning-fast digital pathway. Let's explore this journey step by step.

The customer experience: Customers place orders.

It all begins with customer intent. After browsing and selecting items, the customer proceeds to checkout, where they enter their payment credentials — card number, expiration date, CVV, and billing address — on the merchant's website or app.

Behind-the-scenes security: Customer enters payment information.

Once submitted, this sensitive credit card information needs protection. The merchant's website immediately encrypts the data and securely transmits it to the payment gateway, the first checkpoint in the verification process.

The verification network: Payment authorization.

The transaction details flow seamlessly from the payment gateway to the payment processor, which acts as a traffic director. The payment processor then routes the request through the appropriate card network (such as Visa or Mastercard) until it reaches the customer's issuing bank for verification.

The moment of truth: Payment approval.

At this critical juncture, the issuing bank performs several essential checks. It verifies available funds or credit, confirms security details like the CVV and Address Verification System (AVS), and ultimately decides to approve or decline the transaction.

The return journey: Order confirmation.

The bank's decision doesn't stay put. Whether approved or declined, the response message travels back through the same channels — card network, payment processor, payment gateway — until it reaches the merchant's website, where the customer receives confirmation.

Behind the curtain: Settlement.

The visible transaction may be complete, but the financial journey continues. If approved, the issuing bank sends the funds (minus interchange fees) through the card network to the acquiring bank. This financial institution, known as the acquiring bank, deposits the money into the merchant's account after deducting its fees and processor charges. However, this settlement typically happens in batches rather than instantly, usually taking one to three business days.

Closing the loop: Payment reconciliation.

Finally, the merchant's system reconciles the payment with the order, ensuring everything balances correctly. This involves cross-checking the payment details with the order information to maintain financial accuracy and complete the ecommerce payment processing cycle.

Popular ecommerce payment methods

From traditional banking to cutting-edge digital solutions, online shoppers enjoy unprecedented payment flexibility when buying.

Credit and debit cards.

The backbone of online commerce, these bank-issued plastic cards offer secure transactions with robust fraud protection while building credit history or directly accessing your funds.

Digital wallets.

Virtual payment powerhouses like PayPal and Apple Pay revolutionise checkout experiences by securely storing multiple payment methods for fast transactions across devices and platforms.

Bank transfers and ACH payments.

Direct account-to-account money movement provides enhanced security and reduced processing fees for merchants while giving customers peace of mind through established banking infrastructure.

Buy Now, Pay Later (BNPL) options.

Financial flexibility meets instant gratification as merchant services like Klarna and Afterpay transform major credit purchases into manageable instalments without the traditional burden of credit card interest.

Cryptocurrency.

Blockchain-powered digital currencies enable borderless, decentralized transactions with enhanced privacy and reduced fees, representing the cutting edge of financial technology innovation.

Prepaid cards.

Perfect for budgeting, gifting or anonymous shopping, these pre-funded payment instruments offer spending control without requiring bank accounts or credit checks.

How to choose the right ecommerce payment provider

Choosing the right payment provider for your online store isn't just a technical decision — it's a strategic one that directly impacts your bottom line and customer experience. Here's how to make this critical choice with confidence:

Assess your business fundamentals.

Before diving into options, evaluate your transaction volumes, business model, technical capabilities, and industry risk profile. High-volume sellers need solutions different from boutique shops, while subscription businesses require recurring billing functionality.

Look beyond the basic fee structure.

Don't be lured by advertised rates alone. Compare pricing models (flat-rate, interchange-plus, or tiered) while accounting for all potential costs — from gateway fees to chargeback penalties. The most transparent provider often delivers better long-term value than the cheapest option.

Ensure seamless platform integration.

Your payment solution must work flawlessly with your ecommerce platform. Whether you need plug-and-play simplicity or robust API capabilities, prioritise providers with proven compatibility for your specific setup.

Prioritise security without compromise.

With digital fraud on the rise, robust security isn't optional. Look for PCI DSS compliance and advanced fraud prevention tools, including address verification, 3D Secure, and AI-powered detection systems.

Match payment options to customer preferences.

Your ideal provider should support your target audience's payment methods, including local options and multiple currencies for international businesses.

Why payment processing makes or breaks customer experience

In the digital marketplace, your checkout experience isn't just a transaction — the last impression determines whether customers complete their purchase or abandon their shopping cart. The most beautiful website and perfect product selection mean nothing if customers can't easily pay. A streamlined payment process doesn't just process transactions; it builds trust, encourages repeat business, and significantly impacts your bottom line.

Simplify the checkout flow.

A streamlined checkout process is your secret weapon against cart abandonment. Choose between hosted checkouts, which redirect customers but simplify your security requirements, or integrated checkouts, which keep customers on your site for a more cohesive experience but require additional technical implementation.

Offer multiple payment options.

Customers expect choices. Beyond essential credit cards (Visa, Mastercard, Amex, and Discover), consider offering digital wallets like PayPal, Apple Pay, and Google Pay to boost conversions. Other options include BNPL and multi-currency support for global shoppers.

Enable guest checkout and auto-fill.

Speed and reliability are non-negotiable in ecommerce. Downtime means lost sales while forcing account creation, which adds unnecessary friction. Implement guest checkout options and leverage browser auto-fill capabilities to create a faster, more convenient payment experience.

Optimise for mobile users.

With mobile commerce continuing its rapid growth, your checkout must perform flawlessly on smaller screens. Ensure responsive design, touch-friendly elements, and simplified forms that accommodate mobile payments.

Localise for international shoppers.

Different regions have unique payment preferences. Customizing your payment options based on geographic location shows customers you understand their needs and increases conversion rates in international markets.

The future of online payments

The payments landscape is undergoing a revolutionary transformation. As digital commerce continues its exponential growth, payment processing is evolving from a mere transaction step to an intelligent, seamless experience that shapes the entire customer journey.

Seamlessness and "invisible" payments.

The future checkout experience will virtually disappear into the background of the shopping journey. One-click solutions, securely stored payment credentials, and embedded payment technologies will create frictionless transactions. Biometric authentication using fingerprints, facial recognition, and potentially voice patterns will replace traditional passwords, especially on mobile devices. We'll also see contextual payments triggered automatically by IoT devices — imagine your refrigerator ordering and paying for groceries without human intervention.

AI-powered security and personalisation.

Artificial intelligence will revolutionise fraud prevention through real-time pattern recognition across vast datasets beyond human capabilities. Security measures will become more dynamic, with adaptive authentication that adjusts based on risk signals rather than applying uniform rules. The checkout experience will become hyper-personalised, with merchants proactively offering preferred payment methods and tailored financing options based on customer behaviour.

Borderless commerce.

Payment providers will create unified platforms handling multi-currency pricing, local payment methods, foreign exchange, and international compliance, making global selling significantly easier for merchants of all sizes. Cross-border payments remain a complex challenge, with industry experts noting that, unlike domestic systems, "there's no single rulebook or framework that all banks follow."

Crypto and decentralized finance (DeFi) innovations.

While volatile cryptocurrencies remain niche for everyday transactions, stablecoins and Central Bank Digital Currencies show promise for faster, cheaper cross-border payments as regulatory frameworks mature. Though growing, DeFi represents a small fraction of overall ecommerce volume compared to cards, digital wallets, or even BNPL.

How BigCommerce supports ecommerce payments

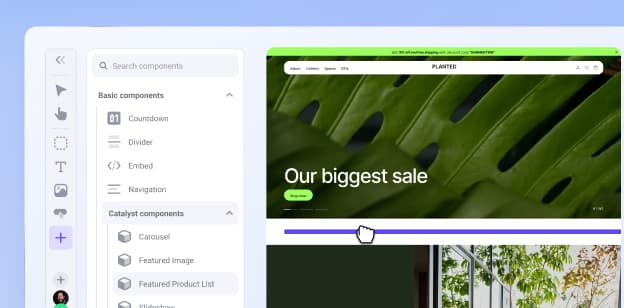

BigCommerce offers robust integrations and flexible options to support your ecommerce payment strategy, whether you're a small ecommerce business or an enterprise brand.

Pre-integrated payment gateways and providers.

BigCommerce simplifies ecommerce payments by offering over 65 pre-integrated, PCI-compliant payment gateways, enabling merchants to accept payments in more than 140 currencies across 230 countries.

With a one-click setup, businesses can quickly establish credit card processing. The platform supports digital wallets like Amazon Pay and Google Pay, enhancing mobile shopping experiences. It also provides accelerated checkout options, such as Stripe Link and PayPal Fastlane, to streamline purchasing.

Importantly, merchants can choose their preferred payment providers without incurring additional transaction fees, making BigCommerce a flexible and cost-effective ecommerce solution for global operations.

Multi-currency and localized payment support.

Accepting payments and displaying prices in more than 100 currencies, BigCommerce helps small businesses worldwide to stake a claim in their local markets through connections with Stripe, PayPal, and Adyen. Customers experience online shopping in their local currency format, while businesses benefit from precise exchange calculations. Global sales expand as a natural consequence of seeing familiar currency symbols during the checkout process. No extra charges apply for these cross-border capabilities. Your international clients will appreciate the convenience of purchasing without mental math or conversion surprises.

Seamless checkout customisation options.

Our enhanced ecommerce payment system provides customers with a fully customisable, single-page checkout experience. Features include guest checkout options, wallet integrations from multiple providers, various languages and currencies support, and convenient "Buy Now" buttons embedded throughout your site. Each element works together to streamline purchasing, decrease abandoned carts and boost conversions by creating an experience tailored to shopper preferences.

Scalable infrastructure for global expansion.

BigCommerce supports payment processing and worldwide growth through reliable, scalable systems. Hosted on Google Cloud, it ensures high performance and reliability, even during peak traffic. Customer data remains protected thanks to PCI DSS Level 1 certification and ISO/IEC 27001:2022 compliance measures.

Flexibility comes from API-driven architecture that enables custom checkout experiences and various integrations. With tools for localized storefronts, language support, and regional payment methods, BigCommerce empowers businesses to manage international expansion from a single, central hub efficiently.

The final word

Payment gateways are booming globally, with projections showing growth to $161 billion by 2032. Behind every online purchase lies a sophisticated system connecting various components — secure gateways encrypt data, processors handle transactions, and merchant accounts receive funds. Your customer clicks "buy" and starts a behind-the-scenes verification journey ending in settlement days later.

Businesses must offer payment variety, including cards, digital wallets, and cryptocurrencies, to satisfy diverse shoppers. Future payment systems are evolving toward invisible experiences where automation eliminates checkout friction. AI technology enhances security measures and creates personalised experiences tailored to individual preferences.

Excellent customer support throughout this process remains crucial for building trust and reducing abandoned carts. Platforms such as BigCommerce give merchants powerful tools: integrated gateways, multiple currency options, and customisable checkout flows that help expand into international markets seamlessly.

FAQs about types of payments

A payment gateway is a secure payment technology that acts like an online POS terminal. It encrypts and transmits customer payment data from your ecommerce website to the payment processor for authorization. You typically need a separate merchant account.

A payment service provider (PSP) is a broader, often all-in-one payment processing solution. It includes gateway functionality but also handles payment processing. It usually provides the merchant account (or equivalent), supports multiple payment methods, and offers fraud prevention tools, simplifying the entire process under a single provider.

Some payment service providers (PSPs) may offer faster settlement options, sometimes with next-day or even faster processing for specific platforms or fees, but the standard timeframe remains one to three business days. Bank transfers, such as ACH, can sometimes take slightly longer to settle than credit card payments.

Yes, absolutely. Stores can accept recurring ecommerce transactions or subscription payments. Common use cases include:

Software as a Service (SaaS)

Streaming services (video, music)

Subscription boxes (e.g., beauty products, coffee, snacks)

Membership sites (online courses, premium content)

Recurring donations for non-profits

Service retainers

While it's a standard capability, setting it up requires choosing a payment provider with the necessary features and correctly configuring the billing logic.

When a customer disputes a transaction, their bank (the issuer) initiates a chargeback. This process immediately withdraws the disputed amount from the merchant's bank account and notifies them of the claim.

The merchant can then contest the chargeback by submitting compelling evidence, such as proof of delivery, service completion documentation, or customer communications. The issuing bank thoroughly reviews this evidence before rendering a final decision.

If the decision favors the customer, the funds remain permanently withdrawn from the merchant, who typically incurs an additional chargeback fee. Merchants who successfully challenge chargebacks must provide comprehensive documentation establishing the transaction's legitimacy.